BR> Clear Transactions

Summary

The Clear Transactions process is used to clear checks or deposits. Use this process each time you receive a bank statement that lists the checks and deposits that have cleared on your bank accounts. The Clear Transactions process can be used to clear AP and Payroll module checks, Clearing House module receipts processed in the Receipt Deposits process (BR> Receipt Deposits), checks created in the Check Maintenance window (BR> Utilities> Enter Checks), and deposits/adjustments entered in the Deposit Maintenance window (BR> Utilities> Enter Deposits).

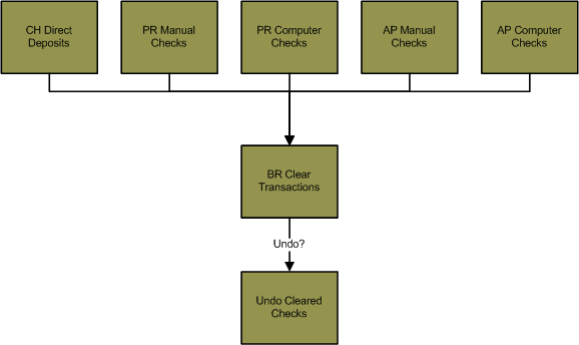

Flowchart

Each object in the diagram below represents a process in the application.

|

Related Links

Click here for information on the Receipt Deposits process.

Click here for information on creating a check in the BR module.

Click here for information on creating a deposit or adjustment in the BR module.

Click here for information on exporting the information in a grid to an MS Excel spreadsheet.

Step by Step

- The Clear Transactions process is a single batch process, meaning you can process only one batch at a time. Click here for information on single batch versus multi-batch processes.

- If there is an open batch in the Clear Transactions process, you will not be able to create a new batch. If you would like to create a new batch, you can either delete the existing batch (highlight the batch in the batch number drop-down at the top of the Clear Transactions palette and press DELETE), or you can reset the steps on the palette by returning to the first step of the process. All of the information in the batch will be overwritten. For example, if another user has selected the checks to be cleared and has stopped at the Proof List step, that user’s work will be overwritten if you run the Batch Settings step. The checks selected to be cleared by the other user will not be cleared and the batch step will return to the Clear Transactions step.

- If there are no open batches in the process and you would like to create a new batch, select New in the batch number drop-down menu at the top of the palette. This will open the New Batch window. The batch number, batch month, and batch year of the batch will not affect the invoices voided in the process. The batch information is for reference purposes only.

- Select Batch Settings from the Clear Transactions palette. This will open the Clear Transactions Settings window.

- The Batch Settings step is used to select the bank account or bank accounts you would like to clear checks on. For example, if you just received a statement on your Bank of America account, select that bank account in the Clear Transactions Settings window.

- Select the bank accounts in the Bank Accounts field. Only the checks and deposits on the selected bank accounts will display in the Select Transactions window later on when you select the checks and deposits to clear.

- Select multiple bank accounts if you would like to clear checks on multiple bank accounts in a single batch.

- Press CTRL+A to highlight all of the bank accounts in the field. Press SPACE to check or uncheck all of the selected toggles.

- Bank accounts are created and maintained using the Bank Account Maintenance window (SS> Maintenance> Bank Account).

- If you are importing transactions into the Clear Transactions batch using the Import Transactions step (BR> Clear Transactions> Import Transactions), only bank accounts selected in this field will display in the Bank Account drop-down menu on the Import Transactions window.

- Enter the date of the bank statement in the Statement Date field. The statement date will default to the current date when you are creating a new batch.

- The Statement Date will be used to filter the checks that can be cleared in the batch. Only checks with a check date greater than or equal to the statement date can be cleared in the batch.

- The statement date is not the same as the clear date of the transactions in the batch. The clear date will be set during the Commit step (BR> Clear Transactions> Commit> Clear Date field).

- Press ENTER or click the Confirm icon

when complete to process the batch immediately, or enter a date and time in the

field next to the Confirm icon to schedule the batch to be processed at a later time.

when complete to process the batch immediately, or enter a date and time in the

field next to the Confirm icon to schedule the batch to be processed at a later time. - You can view the progress of the Batch Settings step using the Jobs Viewer window (Jobs Viewer icon

on the main

desktop). Click here

for information on the Jobs Viewer window.

on the main

desktop). Click here

for information on the Jobs Viewer window.

- Skip this step if you are not going to import a list of cleared checks from a file.

- The Import Transactions process is used to import a list of cleared checks from a file. The checks in the import file must already be entered into the Bank Reconciliation module (for example, AP module Computer Checks that have been committed), and the import file must contain the check number of the cleared check. The imported checks will be selected in the Select Transactions window.

- The Import Transactions process is not used to create a check by importing the check information. If you would like to create a check in the Bank Reconciliation from an import file, use the Import Checks process (BR> Utilities> Import Checks).

- The standard format of this file is a CSV file with the check number entered in the first column of the second row (A2 in an Excel spreadsheet). If you would like to import a list of cleared checks in another format, you may have to get the Import step customized.

- You can run the import process more than once in a single batch. For example, if you have two files with check numbers you would like to import, run the Import Transactions step twice to import the check numbers from both files. When you open the Select Transactions window, the checks in both files will be selected.

- Select Import Transactions from the Clear Transactions palette. This will open the Import Transactions window.

- Select an import file Configuration for the import.

- A BR Clear Transactions-specific import configuration can be created before importing a file into the process. Import configurations are created and maintained on the Import Configuration Maintenance window (SS> Maintenance> Import Configuration). Click here for information on the Import Configuration window.

- The standard Springbrook configuration can be selected by choosing (Standard) from the drop-down menu.

- Once the desired configuration is selected, click the Layout icon

to open the Import Configuration window to display the expected format of the imported file.

to open the Import Configuration window to display the expected format of the imported file.

- Select a bank account in the Bank Account drop-down menu.

- Only bank accounts selected during the Settings step (BR> Clear Transactions> Settings> Bank Accounts section) will display in the drop-down menu. If you would like to select a bank that is not in the drop-down menu, return to the Settings step and select that bank, and then return to the Import step.

- The Account Number field will display the bank account number of the bank selected in the Bank Account field.

- Use the Bank Maintenance window (SS> Maintenance> Bank Account> Account # field) if you would like to modify the bank account number.

- The File Location field is used to select the path of the list of cleared checks to import.

- Click the File Location field label to locate the file. This will open a browse window to locate the file.

- Click the Layout icon

at the top of the window if you would like to view the layout of the expected import file. If

the check number of the cleared checks is not in the correct position on the

import file, no checks will be imported into the batch.

at the top of the window if you would like to view the layout of the expected import file. If

the check number of the cleared checks is not in the correct position on the

import file, no checks will be imported into the batch. - Click the Confirm icon

when complete to import the list of cleared checks.

when complete to import the list of cleared checks. - The import process is performed immediately, so you cannot schedule this task on the application server like other batch steps or reports.

- Once the import is complete, the imported checks will be selected in the Select Transactions step. If there was an error in the file (for example, the file is in the wrong format or the one of the check numbers in the import file is not in the Bank Reconciliation module), an information window will open.

- Click on the Select Transactions step on the Clear Transactions palette. This will open the Select Transactions window.

- The Select Transactions step is used to select the checks to clear. Only checks and deposits on bank accounts selected during the Batch Settings step will display in the Select Transactions window.

- If you imported a list of cleared checks using the Import Transactions step (BR> Clear Transactions> Import Transactions), the imported checks will already be selected in the window.

- If a Payroll module paycheck is in an open Void Checks batch (PR> Void Checks), the check will not display in the window. If you would like to clear a check that is selected in a Void Checks batch, remove the check from the batch, regenerate the Clear Transactions batch (BR> Clear Transactions), and then the check will display in the Select Transactions window. Click here for information on the Void Checks process.

- If you would like to export the transactions that display in the window to a MS Excel spreadsheet, right click on the data in the window and select Export grid contents to Excel from the menu. All of the transactions that display in the window will be included in the spreadsheet, not just the selected transactions.

- Every check or deposit with the Selected toggle checked will be included in the Clear Transactions batch. You can either manually check the Selected toggle of each transaction you would like to include in the batch, or you can use the Select/Deselect Criteria section to check or uncheck the Selected toggle of transactions based on some filter criteria. You can use filter fields in the Select/Deselect Criteria section as many times as you'd like in order to select the transactions that should be included in the batch.

- The Select/Deselect Criteria section is used in conjunction with the

Select

icon

at the top of the window, and can be used to either add checks/deposits

to the Clear Transactions batch or remove them.

at the top of the window, and can be used to either add checks/deposits

to the Clear Transactions batch or remove them. - You can add checks or deposits to the Clear Transactions Batch. If

you would like to clear all checks with a check date between 06/01/20

and 06/15/20, enter those dates in the Check Date From and Check Date To fields. Click the Select

icon

drop-down menu and select Some. All checks in the window with a check date

between 06/01/20 and 06/15/20 will have the Selected toggle

checked. This will also select all deposits with a deposit date of

06/01/20 and 06/15/20. If you would like to deselect the deposits, click

the Check Number column heading to sort the transactions by check

number and then uncheck the Selected toggle of the deposit

transactions.

drop-down menu and select Some. All checks in the window with a check date

between 06/01/20 and 06/15/20 will have the Selected toggle

checked. This will also select all deposits with a deposit date of

06/01/20 and 06/15/20. If you would like to deselect the deposits, click

the Check Number column heading to sort the transactions by check

number and then uncheck the Selected toggle of the deposit

transactions. - You can also remove checks or deposits from the Clear Transactions Batch. Use the Select/Deselect Criteria section to uncheck the

Selected toggle on a transaction. This allows you to deselect a range of checks that have already been

selected. For example, enter 1000 and 1200 in the Check Number From and Check Number To fields, and then click the

Select icon

. This will select all transactions with a check number of 1000 to

1200. Enter 1125 and 1150 in the Check Number From and

Check Number To fields, click the

Select icon

. This will select all transactions with a check number of 1000 to

1200. Enter 1125 and 1150 in the Check Number From and

Check Number To fields, click the

Select icon  drop-down menu and select Deselect Some. The selected transactions with a check

number between 1125 and 1150 will be deselected.

drop-down menu and select Deselect Some. The selected transactions with a check

number between 1125 and 1150 will be deselected. - The Vendor and Employee fields are used to clear transactions by Account Payable module vendor or Payroll module employee. Click the Vendor or Employee field label to select a vendor or employee from a list.

- Click the Select All

or Deselect All

or Deselect All  icons to select or deselect all of the transactions in the window.

icons to select or deselect all of the transactions in the window. - Click the Save icon

when complete to save the selected transactions.

when complete to save the selected transactions.

- The Proof List Report will display a list of transactions that were selected in the Select Transactions step.

- Select Proof List from the Clear Transactions palette. This will open the Proof List window.

- Check the Page break by bank code toggle if you would like the each bank included on the report to display on a separate page. This applies if you have cleared transactions on bank accounts that are attached to multiple banks.

- Check the Page break by bank account toggle if you would like each bank account included on the report to display on a separate page. This applies if you have cleared transactions on multiple bank accounts.

- Click the Print icon

to process the report immediately or enter a date and time in the field next to the Print icon to schedule the report to generate at a later time.

You can view the progress of the report on the Job Viewer window (SS> Utilities> Show Scheduled Jobs). Click here for information on the Jobs Viewer window.

to process the report immediately or enter a date and time in the field next to the Print icon to schedule the report to generate at a later time.

You can view the progress of the report on the Job Viewer window (SS> Utilities> Show Scheduled Jobs). Click here for information on the Jobs Viewer window.- Click the Print icon drop-down menu and select Print Preview to preview the report before printing.

- Click the Print icon drop-down menu and select Excel to export the report data to an Excel spreadsheet as unformatted data.

- Click the Print icon drop-down menu and select Excel (Formatted) to export the report data to an Excel spreadsheet that includes much of the Springbrook formatting found on the printed version of the report.

- Once the report is generated, you can also display the report using the View Reports window (SS> Utilities> View Report). Click here for information on the View Reports window.

- The Bank Activity Report displays the balance and activity of a selected bank during a date range. Each bank account attached to the banks included on the report will be totaled separately. The report will display a beginning and ending balance, the transactions on the bank account, and the clear date of each transaction. The report will display both checks and deposits.

- Select Bank Activity from the Clear Transactions palette. This will open the Bank Activity window.

- Select a bank account from the Bank drop-down menu or select All to include all banks accounts in the report.

- The Bank drop-down menu will display all banks that have been created in the Bank Maintenance window (SS> Maintenance> Bank).

- The Bank Account field is used in conjunction with the Bank

drop-down menu. Select a Bank Account from the drop-down menu

to filter the report by a specific bank account attached to the bank

selected in the Bank drop-down menu. Select All if you would like to

include all of the bank accounts attached to the bank selected in the Bank field.

- Bank accounts are created using the Bank Account Maintenance window (SS> Maintenance> Bank Account). Banks are attached to a bank account in the Bank Code field on the Bank Account Maintenance window.

- The Date From and Date To fields are used to select the activity that will display on the report. If the check date or clear date of a transaction falls within the date range entered in these fields, the transaction will be included on the report.

- For example, if the report is filtered by 12/01/20 and 12/31/20, a check with a check date of 11/15/20 but a clear date of 12/28/20 will be included on the report because the clear date occurs during the date range.

- The check date of a deposit is the deposit date set when the deposit was created (BR> Receipt Deposits> Deposit Date field, or BR> Utilities> Enter Deposits> Deposit Date field).

- The clear date of a transaction is set during the Commit step of the Clear Transactions process (BR> Clear Transactions> Commit> Clear Date field).

- Check the Page break by bank code toggle if you would like to each bank included on the report to display on a separate page.

- Check the Page break by account toggle if you would like each bank account to display on a separate page.

- Check the Show Uncleared Items toggle to include un-cleared

checks on the report. The un-cleared checks and deposits will display

“Un-cleared” in the Date Cleared column of the report, and

will be grouped together at the bottom of the report.

- If the Show Uncleared Items toggle is checked, the Use historical data for specified date range toggle will be enabled. Check this toggle to include any check that was uncleared by the Date To as long as it does not have a void date before or equal to the Date To date.

- Click the Print icon

to process the report immediately or enter a date and time in the field next to the Print icon to schedule the report to generate at a later time.

You can view the progress of the report on the Job Viewer window (SS> Utilities> Show Scheduled Jobs). Click here for information on the Jobs Viewer window.

to process the report immediately or enter a date and time in the field next to the Print icon to schedule the report to generate at a later time.

You can view the progress of the report on the Job Viewer window (SS> Utilities> Show Scheduled Jobs). Click here for information on the Jobs Viewer window.- Click the Print icon drop-down menu and select Print Preview to preview the report before printing.

- Click the Print icon drop-down menu and select Excel to export the report data to an Excel spreadsheet as unformatted data.

- Click the Print icon drop-down menu and select Excel (Formatted) to export the report data to an Excel spreadsheet that includes much of the Springbrook formatting found on the printed version of the report.

- Once the report is generated, you can also display the report using the View Reports window (SS> Utilities> View Report). Click here for information on the View Reports window.

- The Commit step is used to commit the transactions that were selected in the Select Transactions step.

- Select Commit from the Clear Transactions palette. This will open the Commit window.

- The Commit step will only be enabled after the Proof List has been printed.

- Enter the clear date of the transactions in the Clear Date field.

- Press ENTER when complete or enter a date in the field next to the Confirm icon

if you would like to schedule when the

transactions will be cleared.

if you would like to schedule when the

transactions will be cleared. - You can view the progress of the Commit step on the Jobs Viewer window (Jobs Viewer icon

on the main desktop).

on the main desktop).